In the instructions, the function of the valuation models has been opened for both residential and business properties. We use both a market-based and an income-based approach.

Residential properties

The price and rent estimates we produce are market values produced using the market approach in accordance with the IVS2017 standard, and the estimation methods we use are in line with the AVM EAA standard.

As the main machine learning algorithm, we use Gradient Boosting-type algorithms, which automatically identify the connection of the qualitative and quantitative characteristics of relevant transactions with realized transaction prices and produce an indication of the market value and rent that minimizes the prediction error.

In addition to target and price information, the model has been taught extensive material regarding the location, market situation and the population of the area.

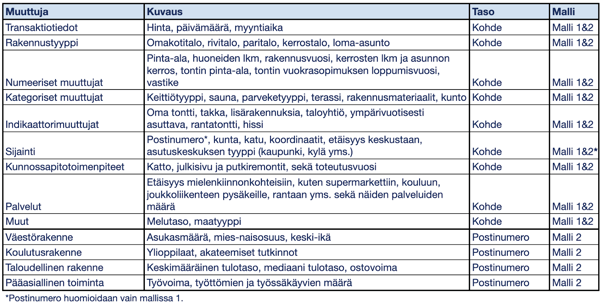

We use two different valuation models when valuing residential properties. Model 1 covers sites located in liquid and urban areas with sufficient transactions. Model 2, on the other hand, covers sparsely populated areas where trade is rarely carried out. The basic variables are the same in both models. In model 2, however, the postcode area is not taken into account, but the area is tied to other areas of the same type through variables describing the population and characteristics. This way we can avoid a situation where only a few trades distort price estimates in illiquid areas. More detailed model variables are detailed below:

Both models enable the valuation of the property types supported by the service and the land areas that belong to them. The types of real estate and condominiums used in the service are: single-family house, terraced house, semi-detached house, high-rise apartment, and leisure apartment. The data is updated and its amount is constantly increasing through both new and existing customers' data. We also enrich the transaction data with other data sources (Appendix 2), which enables consideration of regional and object-specific characteristics.

More detailed descriptions of the model's operation can be found in SkenarioLabs' white paper.

Commercial properties

The price and rent estimates we produce are market values produced using the yield approach in accordance with the IVS2017 standard, and the estimation methods we use are in line with the AVM EAA standard. There is currently one CRE model.

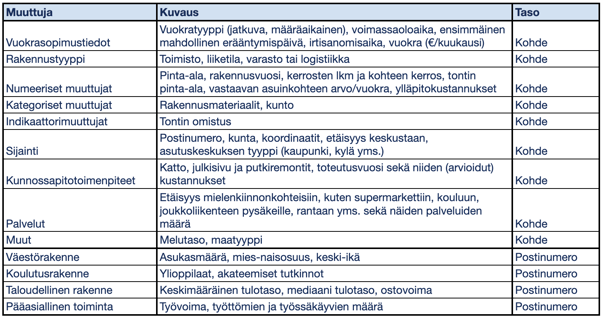

The variables considered in the CRE model are quite similar to the variables of the residential side. The biggest difference is that on the commercial real estate side, rental agreement information is taken into account when evaluating future cash flows, as well as macroeconomic data such as interest rates.

More detailed descriptions of the model's operation can be found in SkenarioLabs' white paper.